Europe’s Consumers in 2025: Cautious Confidence & What It Means for D2C Brands

Image Credit: The Row

As we enter into Q4 of 2025, one of the most crucial quarters in the year for retail businesses we wanted to investigate the EU consumer.

European consumers in 2025 are not swinging between extremes of optimism and gloom. Instead, they’re settling into a middle ground, cautious, but steady. Recent research from McKinsey shows that while inflation remains a top concern, its intensity has eased in many eurozone markets.

Most consumers say they expect to maintain or even increase spending compared with 2024, with the UK leading in optimism. France, on the other hand, shows rising levels of pessimism. This unevenness makes one thing clear: there’s no single “European consumer.” Regional nuance matters more than ever.

Consumer Sentiment Trend (Q1 → Q2 2025) | Shows stability with regional differences

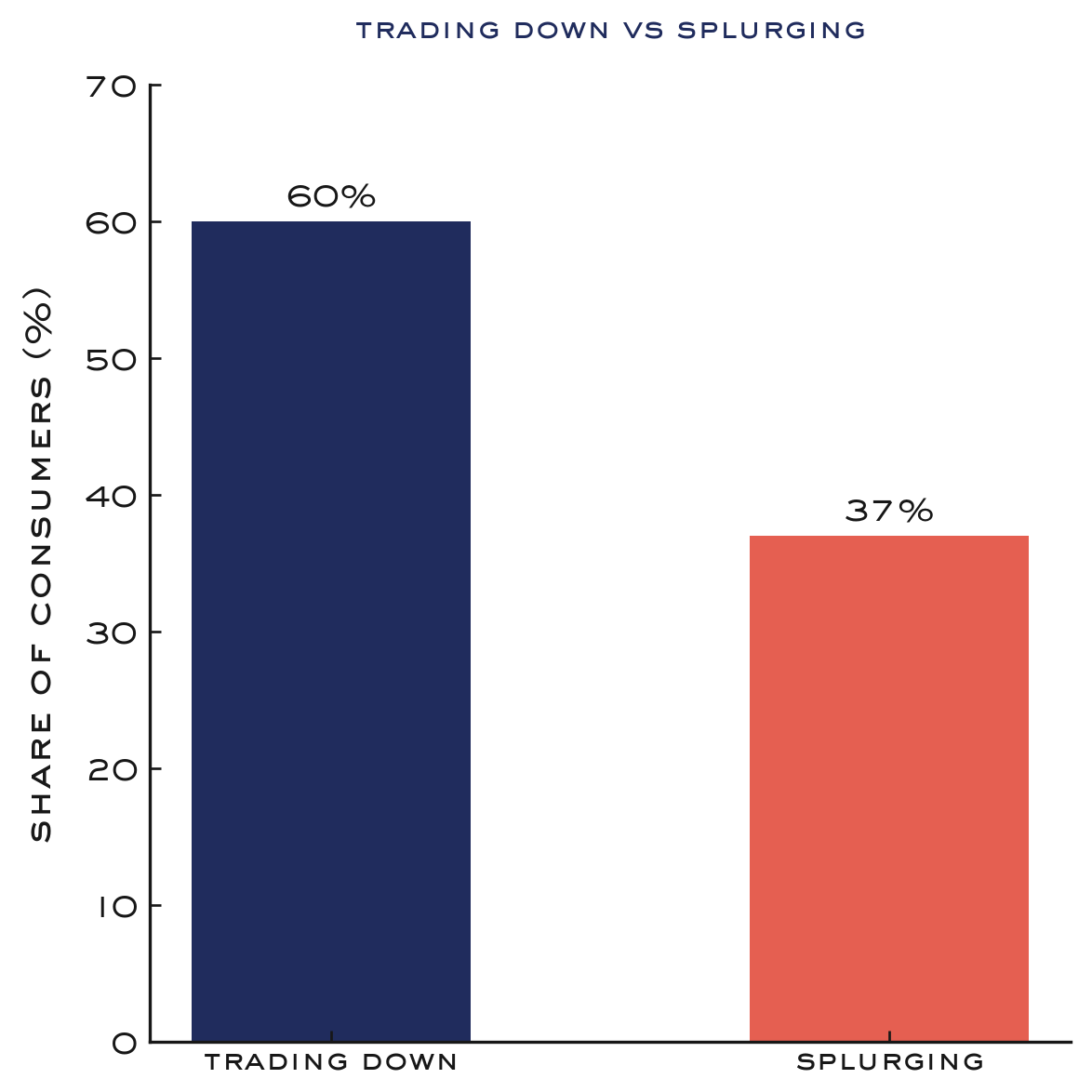

Trading Down Meets Selective Splurging

A key behaviour shaping the market is “trading down.” Consumers continue to buy less, opt for smaller pack sizes, or switch to cheaper alternatives. Younger shoppers, especially Gen Z, are more likely to adjust downward than older groups.

But this story isn’t all restraint. About 37% of Europeans say they plan to “splurge” in the next three months. These splurges lean toward experiences (travel, dining out), while younger consumers skew toward categories like apparel and footwear.

What this means for D2C brands:

Offer entry-level versions or smaller packs to capture value-conscious buyers.

Frame limited promotions and bundles as “small indulgences” to encourage splurging.

Market around emotional rewards (“treat yourself”) rather than blanket discounts.

Trading Down vs. Splurging | Highlights the balance between caution and indulgence

Omnichannel is the default

Another strong signal: hybrid shopping is here to stay. Consumers are blending online research with in-store browsing, often crossing multiple touchpoints before purchase. Expectations are rising for frictionless experiences, fast checkout, easy returns, consistent pricing, and personalised recommendations.

Behind the scenes, that requires better data, personalisation, and agility. For D2C brands, the challenge is to deliver this without enterprise-level budgets.

Practical steps for D2C players:

Integrate sales channels (shopify store + social commerce + occasional pop-ups).

Use low-cost tools to track drop-offs and reactivation opportunities.

Differentiate through customer service: packaging, speed, and personalisation are areas where smaller brands can outshine big players.

A simple hand written ‘thank you’ note in the parcel leaves a bigger impression that one thinks

Key Data Points to Watch

70% of consumers expect to maintain or increase spending in 2025.

37% plan to splurge in the next three months, even amid trade-downs.

Gen Z leads in both trading down and splurging, making them the most dynamic group to target.

Hybrid shopping continues to dominate, underscoring the need for consistent cross-channel experiences.

Spending Intent by Category | Breaks down where consumers are still willing to spend

Takeaways for D2C Brands

Europe’s consumers are best described as cautiously confident. They’re not pulling back entirely, but they are being more selective with when and where they spend.

To win in this environment, D2C businesses should:

Create segmented value tiers to capture trade-down demand.

Enable small indulgences through emotional positioning and micro-promotions.

Invest in personalisation, even simple data insights can sharpen targeting.

Build channel fluency so shoppers get a seamless journey from Instagram to checkout.

Focus their marketing out put on high converting EU countries.

Conclusion

For small and medium direct-to-consumer brands, 2025 isn’t about chasing growth at all costs. It’s about precision, nuance, and agility. The brands that listen carefully, adapt to subtle shifts, and deliver consistent value will not just survive this cautious era they’ll thrive in it.

References: